With Phone Banking, you’re able to easily check your available account balances, transaction history and transfer between your accounts.

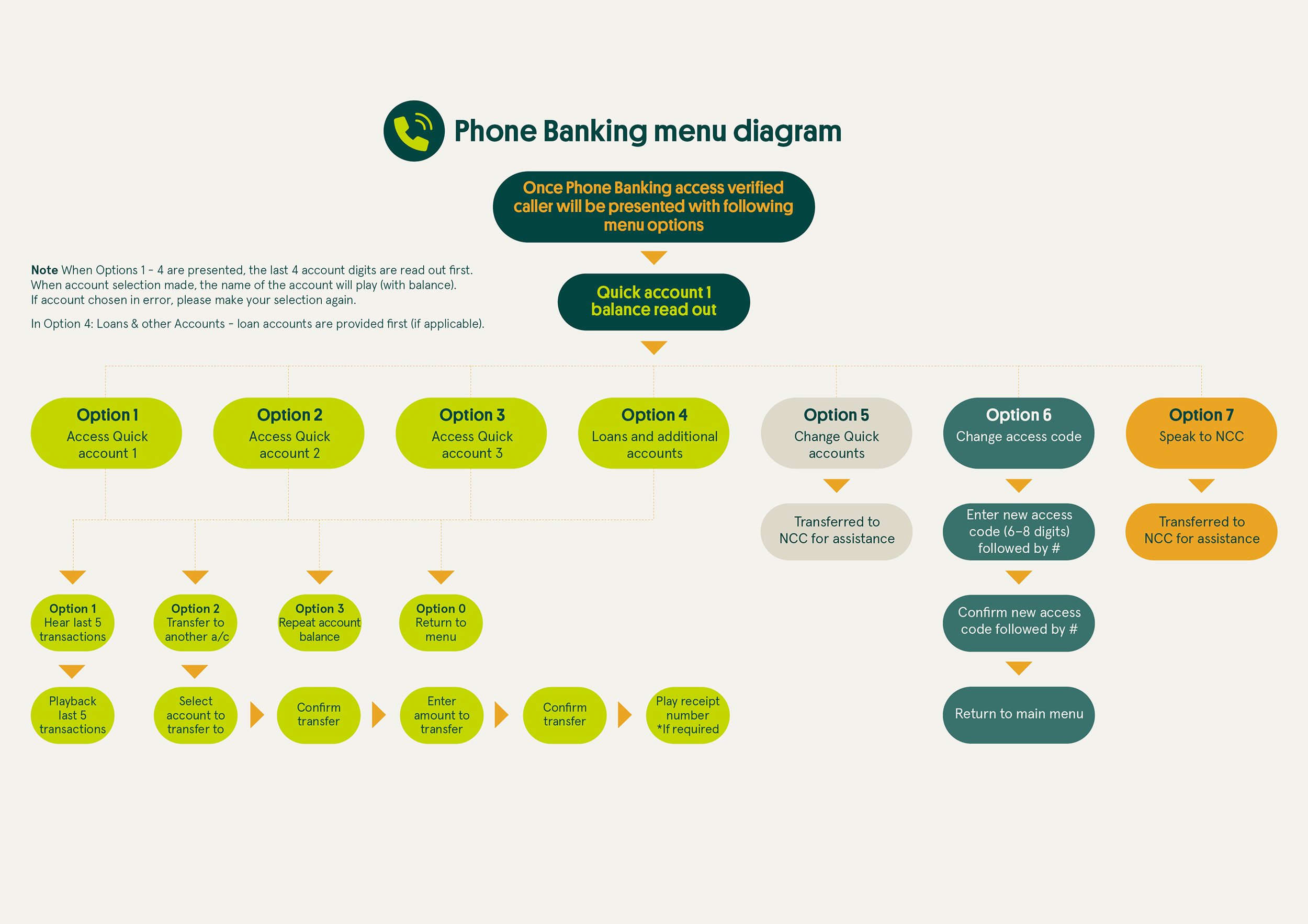

To help you use Phone Banking easily, we’ve created a handy Phone Banking menu diagram :

Download the Phone Banking IVR menu

More personalised service

Your new Phone Banking access code provides you with the ability to verify your identity if you ever need to chat to us (when calling our National Contact Centre and Business Support areas)Accounts access

Access up to 10 accounts using Phone Banking.

Peace of mind

Change your access code at any time quickly and easily.

Most popular questions

Why isn't Phone Banking available 24/7?

While our new Phone Banking service will still be available 7 days a week, it will be offline from 11:00pm to 2:30am (Australian Central Standard Time) each day. This is so we can complete our end of day system processing. We recognise that having our Phone Banking service offline during this time may impact some members, however, you can still access account information via Mobile App and Internet Banking 24/7.Why are you changing your Phone Banking system?

Our Phone Banking is changing. We've recently rolled out a new phone system in our National Contact Centre and as part of this change we’re implementing a new Phone Banking service which will come with an improved self-registration process and reduce the wait time to receive an access code. This is currently delivered by post which can take a few days to arrive, however, with the changes being implemented, members will be able to set up a new access code immediately over the phone.

Another positive change is that if you've updated any account names (e.g. Online Saver to Holiday Account), our new Phone Banking will now reflect this name change (once account selection made).Will I be able to access all of my accounts on Phone Banking?

You'll be able to access up to 10 accounts using Phone Banking. To change which accounts are included, select Option 5: Change Quick Accounts from the menu. To access account information on more than 10 accounts, please use Internet Banking or our Mobile Banking App.

To access account information on more than 10 accounts, please use Internet Banking or our Mobile Banking App.What's changed for me?

The introduction of our new Phone Banking system in March 2022 has brought some small changes to the Phone Banking menu options. You'll still be able to easily obtain your available account balances, transaction history and transfer between your own accounts, however, some menu options that were not being used frequently have been removed.

The way you select an account has also changed slightly. Your account numbers can be found on your statement, or viewed in Internet Banking or on our Mobile Banking App. Once you've selected an account you will then hear the account name. If you realise you've chosen the wrong account, you can return to the menu to select again.

When you select to hear your account balances, only the available balance will play. If you have a term investment with us, it wont be included as an option on Phone Banking. To access information about your term investments quickly and easily, speak to us about our other self service options.

The hours of access to Phone Banking will be changing too. From the date of the change, the service will be unavailable between the hours of 11:00pm and 2:30am (ACST) each day.

You'll be able to use your new Phone Banking access code to verify your identity when you call our National Contact Centre, Business Support or Credit Management Teams. This means you'll be prompted to enter your member number and your access code before you speak to someone from our team, giving you a more personalised experience and reducing your wait time.What benefits will I see?

We’re making it easier for Phone Banking members. Moving forward, you’ll be able to use your new access code to verify your identity when you call our National Contact Centre, Business Support and Credit Management Teams. This means you'll be prompted to enter your member number and your access code before you speak to someone from our team, giving you a more personalised experience and reducing your wait time.

Another positive change is if you've updated any account names (e.g. Online Saver to Holiday Account), our new Phone Banking will now reflect this name change (once account selection made).What is the structure of our Phone Banking menu?

The Phone Banking menu has the following options:

•Option 1: Select quick account 1

•Option 2: Select quick account 2

•Option 3: Select quick account 3

•Option 4: Select loans and all other accounts. (note: if you have loan/s these accounts will be presented first)

All options above allow you to:

•Hear the last 5 transactions (Not available for loan accounts)

•Transfer to another account (Not available for loan accounts, only possible to transfer to a loan account)

•Repeat account balance

•Option 5: Change quick account order - your call will be directed to our contact centre where a team member can do this for you

•Option 6: Change access code

•Option 7: Speak to a consultant - your call will be directed to our contact centre

What if I don't have a mobile number to be able to register for the phone banking service? Can I register for Phone Banking using a landline?

If you want to register for the Phone Banking service and you don't have a mobile phone number recorded with us (or if your mobile number is updated within the last 48 hours) you'll be unable to complete the registration process and will be automatically transferred to our contact centre where a team member will be able help you to create an access code the first time you call through to Phone Banking.What is Access Code Verification?

The new Phone Banking service will provide you with a way we can quickly and easily verify your identity over the phone when you call us, known as Access Code verification. The system will recognise if you've registered for the new Phone Banking service and, if so, will prompt you to enter your access code. This new feature will help us better connect with you the next time you call our National Contact Centre, Business Support or Credit Management Teams.How can I access Phone Banking?

You can access Phone Banking by calling 13 11 82 and selecting Option 1: Self Service Phone Banking. You'll then be prompted to enter your member number and access code.