Related FAQs

Can I change the default account on the home page?

You can change the default account displayed on the home page, press and hold the account tile until the list of accounts is displayed, select the account you wish to be your preferred account from the list. This will become the account displayed on the home screen and the default account for activities such as transfers and viewing transaction history.Can I change the default payment options on the home page?

You can change the default payment options displayed on the home screen, press and hold on the payment option tile you wish to change until the list of payment options is displayed, select the payment option you wish to display as the default. This will become the payment option displayed on the home screen.How do I access all my accounts and services using the App?

The Home Screen allows you to save an account and 2 payment types as your favourites on the home screen. The account will become the default account for activities such as transfers, payment and viewing transaction history.

To access all your accounts :

Android App: Tap on the Account tile on the home screen or select Accounts from the main menu which is available by tapping on the hamburger menu icon in the top left corner of the screen. Your default account will be displayed, tap on this account to display all your accounts.

iPhone App: Tap on the Account tile on the home screen or select Accounts from the main menu which is available by tapping on the hamburger menu icon in the top left corner of the screen. Your default account will be displayed, scroll left and right through to the account you require.

To access all available services tap on the hamburger menu icon in the top left corner of the screen, the main menu will be displayed, tap on the service required from the menu.How do I logout of Mobile Banking?

iPhone and Android: Tap the logout button in the top right hand corner of the screen.

Accessing via Browser: Select 'More Options' in the top menu bar, then select 'Logout'.

If you press the Home button when logged into the app your session will remain active for 90 seconds.Can I register more than one member to the same smartphone?

The PIN and Device security feature only allows one member to register to a device. A member can register with many devices but there can only be one member registered to a single device.How can I register a different member on my smartphone?

To register a different member number to a device that has already been registered you need to:

Android and iPhone App: Select Forgot PIN from the left hand slide-out menu. The device registration page will be displayed for you to register a different member, or if you are logged in select ‘Devices’ from the main menu accessible via the hamburger icon in the top left of the screen. Your registered devices will be displayed with the active device highlighted. Select the active device and delete it.

Accessing via Browser: Clear your Browsers cookies/cache.Is there a monthly or yearly limit of access to Mobile Banking on my smartphone?

No monthly or yearly limit applies.I can't see the Touch ID option in the main menu?

Click on ‘Settings & Terms’ in the left-hand menu to display the list of options. If ‘Touch ID’ is not displayed check a fingerprint(s) has been registered in the iPhone settings. The App ‘Touch ID’ option is only visible if a fingerprint(s) has been registered in the iphone settings.

Currently only the iPhone App supports Touch ID authentication on models iPhone 5S, iPhone 6, iPhone 6Plus. We may review our service offering as more devices make this feature available and meet our security standards.How do I register for Secure Code?

Once you have installed the People’s Choice Mobile Banking App and registered - that’s it.

If you choose to transact via Internet banking at any time, you can access a secure code from the hamburger menu option via your Mobile Banking App, or, simply approve the push notification received to your device.How do I Tap and Pay with Google Pay, Apple Pay or Samsung Pay?

GOOGLE PAY

To Tap and Pay with your phone using Google Pay, simply follow these steps:

Check your mobile number is up to date on your People’s Choice account via internet banking, if it is not up to date, make sure it is before continuing

Register for Google Pay by downloading the Google Play App from the Google Play Store

Add your People’s Choice Credit Union card

Tap & Pay! There's no need to launch the App - simply wake your device to make payments.

APPLE PAY

To Tap and Pay with your phone using Apple Pay, simply follow these steps:

Open the People’s Choice Mobile Banking App

Tap ‘Add your cards now’ at the top of the home screen

Select the card you’d like to add to Apple Pay

Follow the prompts.

SAMSUNG PAY

To Tap and Pay with your phone using Samsung Pay, simply follow these steps:

Download the Samsung Pay App

Open the Samsung Pay app and sign in with your Samsung ID.

Register your fingerprint and device passcode which you’ll use to authorise payments.

Have you got a Galaxy S8 or Galaxy S8+? You can even use iris authentication!

Scan or enter your People’s Choice Visa Debit or Credit card details.

Verify your card details and enter the verification code.How do I change my card pin?

To change your pin, simply follow these steps:

- Sign in to your People’s Choice Mobile App

- Go to card management

- Tap the card you would like to change the pin for

- Select Change Card PIN

- Enter and confirm the new PIN

- Tap Change.What if my fingerprint is not allowing me to authenticate?

If your registered fingerprint doesn’t work you can log in using the App PIN to authenticate by selecting ‘Cancel’ when prompted for Touch ID. The Enter PIN screen will be displayed and you can login using your App PIN.How do I enable and disable Touch ID?

To enable Touch ID you must have your fingerprint(s) registered in the device settings, if your fingerprint is not registered the App ‘Touch Id’ menu option is not available. Ensure only your fingerprint(s) is registered on your device.

You can enable or disable Touch ID at any time, tap the hamburger menu icon in the top left corner of the screen and select ‘Settings and Terms’ then ‘Touch ID’. The Touch ID information screen is displayed with the Touch ID toggle button, read the information on the screen, and slide the toggle button to the right (green) to enable to the left (grey) to disable. For security reasons if you are not logged into the App you will need to authenticate by entering your 4 digit App PIN before you can enable or disable Touch ID.

Note: if Touch ID is enabled you can still opt to log in using the four digit security PIN by selecting ‘Cancel’ when prompted to authenticate.

Currently only the iPhone App supports Touch ID authentication on models iPhone 5S, iPhone 6, iPhone 6Plus. We may review our service offering as more devices make this feature available and meet our security standards.Do I have to register to be able to use People's Choice Mobile Banking?

Not specifically. Once you are registered for Internet Banking, you can use Mobile Banking.

To register for Internet Banking you can click on "Register" from the Internet Banking panel, on the People's Choice home page.Will People's Choice Mobile Banking work on my phone?

To enable Mobile Banking you must have a mobile device capable of accessing the internet. The Mobile Banking Apps require your device to be running a version of the operating system that is supported :

Android - 6.0 and above

iPhone – 12.0 and above

If your device is on an older version of the operating system, you can download the VIP Access App for Mobile here.

Check with your mobile phone provider whether your phone and/or plan enables access to the internet.

Windows and Blackberry phones can also be used to access Mobile Banking.

Visit Mobile Banking for more information.What Mobile Banking Apps are available?

We have free Mobile Banking Apps available for both iPhone and Android mobile phones.

Download them from our Mobile Banking page.

The iPhone App is compatible with iOS 12.0 and above.

The Android App is compatible with Android 6.0 and above.How do I access Mobile Banking?

To use Mobile Banking you must have registered for Internet Banking and have a mobile device that includes internet access. To register for Internet Banking please call us on 13 11 82 or drop into your local branch.

You can access Mobile Banking using an Android or iPhone app which can be downloaded from the Google Play store or iTunes App store by searching 'People's Choice Credit Union’. You will need to ensure your mobile device is running a supported version of the Operating system before using the App :

Android - 6.0 and above

iPhone – 12.0 and above

Windows and Blackberry phones can also be used to access Mobile Banking.

Visit Mobile Banking for more information.How does it work?

People's Choice Mobile Banking Apps can be used from any mobile device that has access to the internet with a version of the operating system that is supported:

Android - 6.0 and above

iPhone – 12.0 and above

Windows and Blackberry phones can also be used to access Mobile Banking.

Visit Mobile Banking for more information.

You can confirm if your mobile has access to the internet with your mobile provider.What is the difference between Internet Banking and Mobile Banking?

Mobile Banking is a feature of Internet Banking and provides quick and easy access to your accounts and common transactions on your mobile device. Internet Banking is a practical way to access full banking services from your computer, tablet or smartphoneWho can use People's Choice Mobile Banking?

People's Choice members registered for Internet Banking can use the Mobile Banking service.What services can I use with People's Choice Mobile Banking?

With Mobile Banking you can:

- Check your account balance via Quick Balance - without logging in

- View your transaction history and access eStatements

- Transfer money to other financial institutions via Osko

- Make a payment to anyone using their PayID (mobile, email or BSB/Account). For more information, visit the Fast Payment FAQ’s

- Pay a bill using BPAY®

- View and edit your scheduled transfers

- Share your account details with your friends and family members easily via social platforms

- Personalise your account names

- Provide App feedback

- Locate your nearest branch or contact us

- Create your own PayID for Fast PaymentsCan I access Mobile Banking from overseas?

If you travel outside Australia you may still have access to our Mobile Banking service. You should check with your telephone communications provider whether your mobile phone will be able to use relevant networks in those countries in which you are travelling. You might have extra charges for having your mobile on international roaming from your telephone communications provider.How do I adjust the Mobile Banking screen size on the screen of my phone?

On most phones you can adjust the screen size to suit. Most phones have a menu screen which will enable you to change the view of your phone from 'slim' to 'widescreen' view for example.What if I lose my mobile phone, is my information secure?

Yes. When you finish banking through People's Choice Mobile Banking you can logout by tapping on the logout icon in the top right hand corner of the screen and therefore exit the system. None of the information accessed through Mobile Banking will be saved on your mobile phone. Do not save your Internet Banking password on your mobile browser in case of loss or theft on your mobile phone.

If you press the Home button when logged into the app your session will remain active for 90 seconds.Are there transaction limits for Mobile Banking?

The current Internet Banking daily limits for transferring money to your own accounts, other memberships at People's Choice Credit Union, other financial institutions or paying bills using BPAY® apply to Smartphone Banking, so any transfers and BPAY® payments made will be included in the daily Internet Banking limit totals.What types of accounts can I access from Mobile Banking?

You can access any type of account you have access to on Internet Banking.How do I make transfers and payments using Mobile Banking?

With Mobile Banking you can:

- Check your account balance via Quick Balance - without logging in

- View your transaction history and access eStatements

- Transfer money to other financial institutions via Osko

- Make a payment to anyone using their PayID (mobile, email or BSB/Account). For more information, visit the Fast Payment FAQ’s

- Pay a bill using BPAY®

- View and edit your scheduled transfers

- Share your account details with your friends and family members easily via social platforms

- Personalise your account names

- Provide App feedback

- Locate your nearest branch or contact us

- Create your own PayID for Fast PaymentsHow can I use Mobile Banking to pay my bills?

If you are using the:

iPhone App: Select the Transfer Pay/Transfer option from the Navigation bar at the bottom of the page then select Bpay and enter Payment details. To select a Bpay from your saved favourites, select the tab on the right hand side of the Bpay screen and then select the biller details. You can also access Bpay from the App dashboard.

Android App: Tap on the hamburger icon on the top left of the screen to display a list of payment options , then select Bpay from the list. If you do not logout using the logout button your session will remain active for 1 minute. You can also access Bpay from the App dashboard.

Accessing via Browser: Select the Bpay symbol from the top Navigation bar and enter Payment Details. To select a Bpay from your saved favourites start typing biller details in Saved Favourites and then select the favourite from the drop down list.When will the updated App be released?

Updates to the People’s Choice Mobile Banking App will be available from 5 April 2022 for Android and 6 April 2022 for iOS.How can I download the People's Choice Mobile Banking App?

The People’s Choice Mobile Banking App is available from the Google Play Store and the App Store. On your smartphone, simply search for People’s Choice Credit Union.How can I send a payment to a People's Choice member?

To pay a People’s Choice member, select ‘Pay Anyone’ in Internet Banking or your Mobile Banking App, select 'PayID' or 'BSB & Account Number' or choose an existing Payee and follow the steps to complete your payment. The Pay Anyone menu item can be found under the Pay menu.

How can I update to the latest Mobile Banking App?

You can update to the latest Android app from the Google Play Store and the iOS (Apple) app from the App Store on your smartphone. Simply open your App Store, find the People’s Choice Mobile Banking App, and select ‘Update’. The app is supported on the following: Android version 6.0 software and above; iOS version 12 software and above.How do I set up Quick Balance?

Simply tap the ‘Quick Balance’ icon from your App Dashboard and you can set up Quick Balance for up to four nominated accounts.

Quick Balance is an easy way for you to check the balance of your accounts through our Mobile Banking App.

To set up Quick Balance on your Mobile Banking App:

- Open your People's Choice Mobile Banking App on your iOS or Android device.

- Tap on the ☰ icon in the top-right of your screen to open the menu.

- Tap the Settings menu.

- Tap quick balance.

- Turn on the accounts you wish to view in Quick Balance using the toggle switches on the right.

- Once you're done setting up accounts to view, tap the menu icon ☰ to go back, and select Dashboard to go back to the main screen.

- From here, you can tap Quick Balance to view your account balances anywhere, any time - no need to log in.

What is Quick Balance?

Quick Balance is a fast and easy option to view the available balance of up to four People's Choice bank accounts, without logging in. This is an optional feature to view your available funds only. You will need to log in to perform any transactions. Please note, Quick Balance is not available on lending or term deposit accounts.Where is my app shortcut (Android users)?

Once you have downloaded the updated app to your device, you may need to reinstall your shortcut on your home screen. This is a function that occurs when updating apps across Android devices.Why can I enter a long description for some payments and not others?

The description field for Fast Payments is 280 characters. When 280 characters are available this means that you will be making a Fast Payment. When making a Fast Payment, the Osko logo will be displayed on the Payment Confirmation screen within Internet Banking and the Mobile Banking App and you will be able to enter a payment description of up to 280 characters. If your payment cannot be processed as a Fast Payment you will only be able to use 18 characters and your payment will be delivered in 48-72 business hours.What devices are supported?

The People’s Choice Mobile Banking App is supported on the following devices: - Android version 6.0 software and above; - iOS version 12.0 software and above.Why do I need to accept Terms and Conditions again?

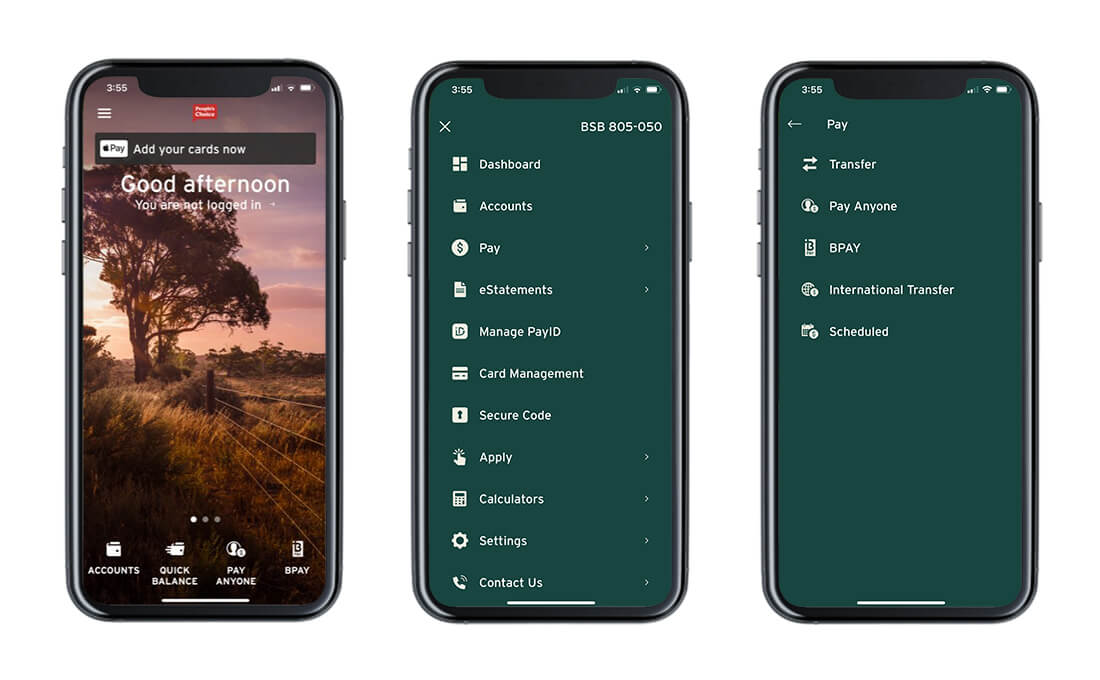

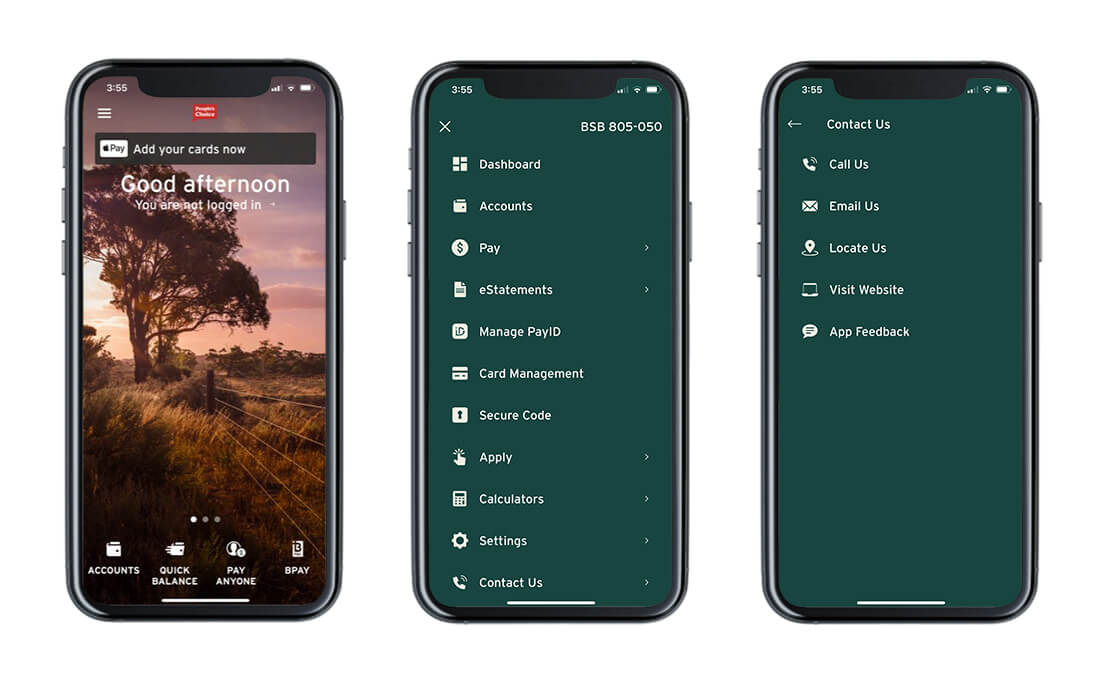

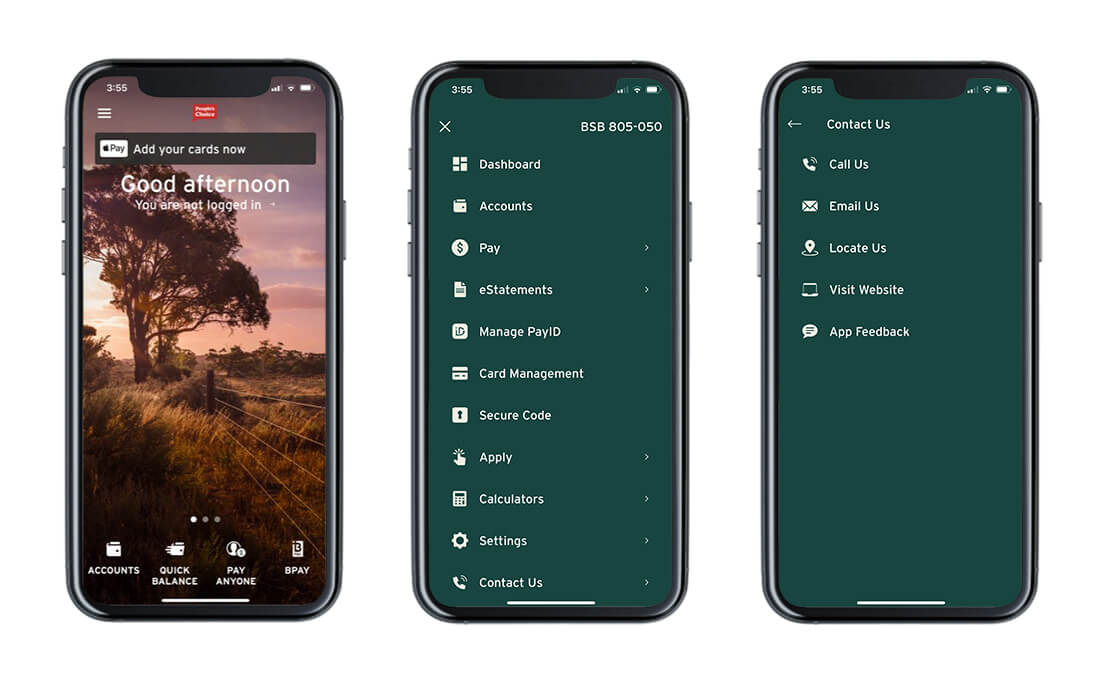

Terms and Conditions are a legal requirement to ensure that our members are informed of the terms of use and legal obligations when using the App. By reading and accepting the Terms and Conditions you are accepting that you are informed and willing to use the App based on those terms and conditions.Has the App menu changed? I can’t find Transfer, Pay Anyone, BPAY or Locate us

To improve our member experience in our Mobile Banking App, selected menu items have been consolidated:

• Consolidated Pay menu now includes Transfer, Pay Anyone, BPAY and International Transfer

• Consolidated Contact Us menu now includes Locate Us

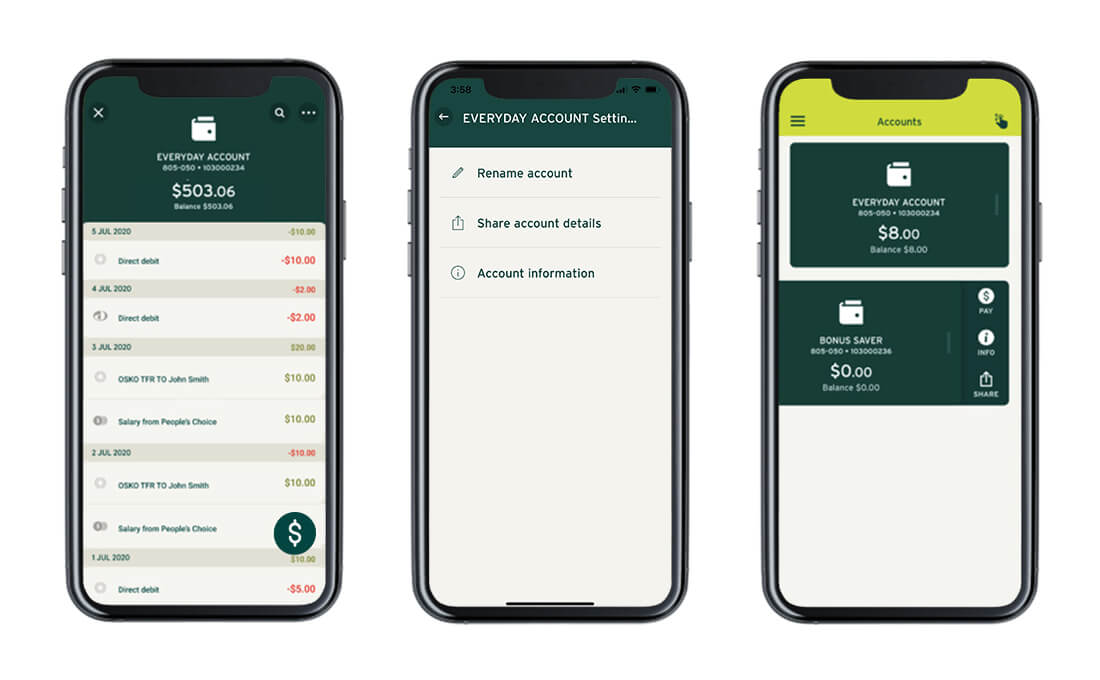

What are the new features of the Mobile Banking App?

There are three new features:

• Renaming accounts

• Share account details

• Improved User Interface (UI)

Renaming accounts:

By selecting the ellipsis or three dots in the top right corner of the account overview page, you will be able to rename your accounts.

Share account details:

Using the slider on the account card, select Share.

Improved User Interface:

A new icon has been added to the accounts screen. You will now be able to see instructions on how to re-order your account cards.

Where has Locate Us moved to in the App and what’s changed?

To improve our member experience, we've consolidated the Locate Us menu in our Mobile Banking App with the Contact Us menu.

Once clicked, 'Locate Us' will launch your browser and take you to the People's Choice website ‘Locate Us’ page.

Why does the image on the App home screen change?

The image on the App home screen changes depending on the time of day. There are four different images: morning, midday, afternoon and night.How do I change my App PIN?

To change your App PIN, simply follow these steps:

• Sign in to your People’s Choice Mobile Banking App

• Go to the Navigation Menu, select ‘Settings’

• Select ‘Change App PIN'

• Enter your current App PIN

• Enter your new preferred App PIN

• Enter and confirm the new PIN

• Tap 'Change'What if I forget my App PIN?

If you happen to forget your App PIN, simply follow these steps:

• From the Navigation Menu, select ‘Settings’

• Select ‘Forgot App Pin’

• You will be prompted to de-register your device and re-register

• Select ‘De-Register’ device

• Follow Re-Registration promptsHow important is the software version I use when it comes to updating the App?

Our Mobile Banking App is designed to operate across various software operating systems, however, there may be different experiences on older software. Not all devices operate the same despite being on the same operating system. It's important to regularly update your device software to ensure it's on the latest operating system wherever possible. This can maximise stability and performance across all apps on your device.I'm having trouble updating to the latest App. What can I do?

1. Restart your device. You should do this often for device health.

2. Update your software version to the latest version. The benefit of frequently updating your device software means you can pick up any security library changes in the code that the device is looking for, (and may block if not on a newer version).

3. If you're having trouble with your PIN after restarting and updating, please call our National Contact Centre on 13 11 82.

Did you find what you are looking for?

Help us improve our website and the information we provide to ensure you get what you need.